SIMRIS ALG With mixed performance for the company’s consumer products in the US during 2020, Simris Alg is now broadening its strategic playing field into three clearly defined divisions. With international heavyweight Steven Schapera as chairman, the next step for Biomimetics and Novel Foods will be unlocking the potential of the company’s unique algal platform.

Report: Johan Widmark | Date: 2021-02-19

As expected after the company’s sales update earlier in February, which showed a slowdown in the previously rapid US growth, sales of omega-3 in the second half of 2020 were lower than our original expectations. More important, however, was the announcement that cosmetics veteran Steven Shapera is taking over as chairman and that the company is emphasising its future direction with a clearer division into three dedicated business areas.

SIMRIS BIOMIMETICS will offer the company’s microalgae for use in advanced skin care and pharmaceuticals through its biotech platform for the discovery and production of various types of active substances. Simris’s research and development platform is offered in combination with its unique production method, which enables the development and manufacture of new and highly active substances and extracts and is therefore expected to command a significantly higher value than other algae products and algae-based ingredients and extracts currently on the market. This also means that the actual value within BIOMIMETICS can be expected to embedded more in the company’s platform for the discovery of new substances than in any individual products or ingredients it can produce.

The first areas are active enzymes that protect the skin against free radicals, anti-inflammatory and prebiotic polysaccharides, and substances for the treatment of atopic dermatitis. The first products in cosmetic skin care are expected to reach the market in 2022.

The BIOMIMETICS business area also includes the company’s investments in the development of production methods for second-generation biopharmaceuticals, which means that the active substance is produced in or extracted from materials of biological origin (i.e. living cells or tissue). The company’s focus in this area is on recombinant DNA technology. In the case of Simris Alg, this means using microalgae as a production platform, which offers advantages compared to ‘more difficult’ cell lines such as mammalian.

SIMRIS NOVEL FOODS focuses on foods and alternative proteins. This is also the origin of the company’s first product line, omega-3 supplements for consumers, which have since been commercialised under the SIMRIS brand and now form the third of the three strategic business areas.

The production of omega-3 currently generates two interesting residual products that can be considered the starting point for NOVEL FOODS: firstly, an algal protein powder with over 55% protein content; and secondly, a tasty algal creme. The protein product is already under development for food applications with a multinational company.

Read more research on Simris Alg here

Algal protein as a bulk product has high volume potential, as evidenced by the strong expected growth of 6% CAGR from 2020 to a global market of USD 1 billion by 2026, according to research company Global Market Insights, but commands a relatively low price. The relationship in BIOMIMETICS is the opposite, with lower volumes but significantly higher price potential.

With our expectations for products in both BIOMIMETICS and NOVEL FOODS to be on the market by 2022, albeit in small volumes, our assessment is that these two divisions have the potential to overshadow the company’s omega-3 products in the long term, although the time horizon is unclear.

The distinct separation of BIOMIMETICS and NOVEL FOODS into their own divisions is a major step towards revealing the value and potential of the company’s platform and shifting the focus away from sales volumes for individual products, which should benefit the valuation of Simris Alg.

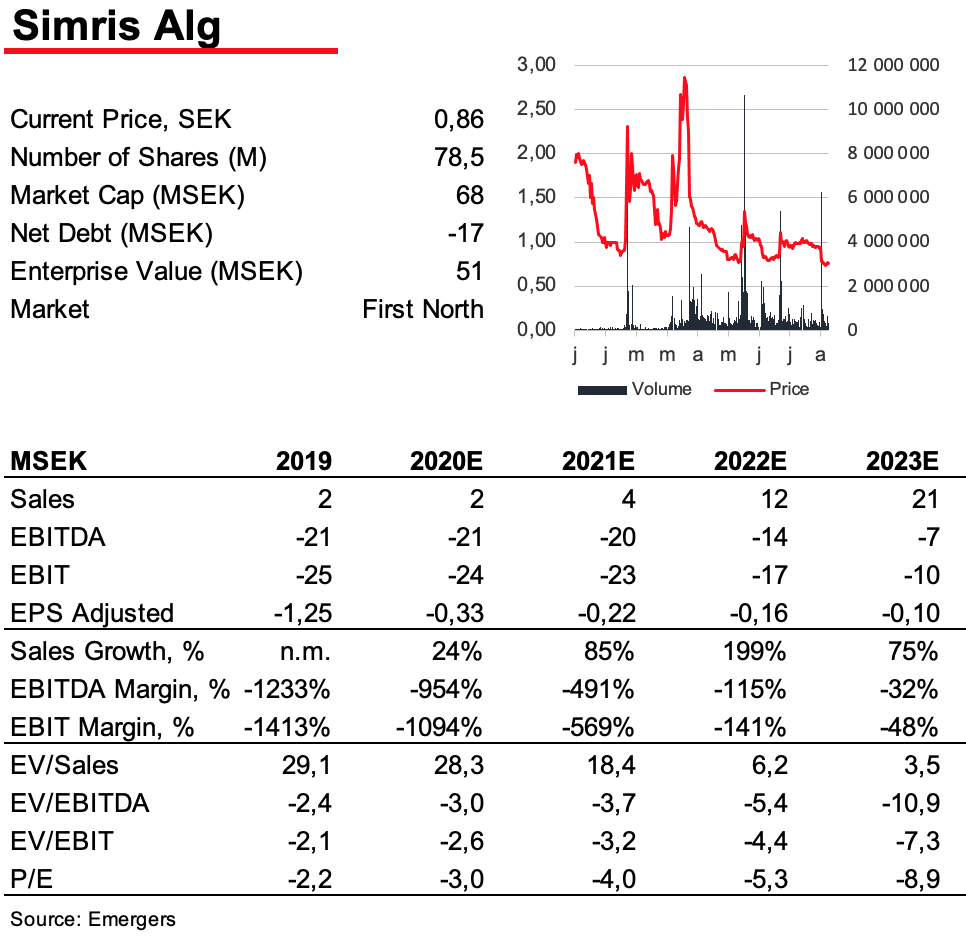

However, it is likely that the company will need to strengthen its finances as early as this year since its cash reserves of SEK 16.5 million will not be enough to cover the annual operating costs of around SEK 20 million. It is therefore reasonable to expect a dilution of 30-50% during the year.

All in all, we see Simris Alg as a highly interesting VC case at the forefront of biotechnology, which in the listed environment is unfortunately weighed down by a tunnel vision of the short-term sales growth in its first product arm, omega-3. With the entry of Steven Schapera as chairman and the emphasis on the company’s three strategic business areas, we see both an operational broadening of the business that should contribute to a reversal of sentiment towards the share, and increased chances for the company to attract a new kind of investor who can hopefully see the development more in a VC perspective, with a greater understanding of both the protracted investments and the long-term potential.

Johan Widmark | Tel: 0739196641 | Mail: johan@emergers.se

DISCLAIMER

Information som tillhandahålls på eller via denna webbplats är inte avsedd att vara finansiell rådgivning. Emergers mottar ersättning för att skriva om bolaget på den här sidan. Bolaget har givits möjlighet att påverka faktapåståenden före publicering, men prognoser, slutsatser och värderingsresonemang är Emergers egna. För att undvika intressekonflikter har Emergers skribenter inga innehav i de noterade bolag vi skriver om. Analysartiklar skall ej betraktas som en rekommendation eller uppmaning att investera i bolagen som det skrivs om. Emergers kan ej garantera att de slutsatser som presenteras i analysen kommer att uppfyllas. Emergers kan ej hållas ansvariga för vare sig direkta eller indirekta skador som orsakats av beslut fattade på grundval av information i denna analys. Investerare uppmanas att komplettera med ytterligare material och information samt konsultera en finansiell rådgivare inför alla investeringsbeslut. För fullständiga villkor se here.